I listen to 97.3FM and am a longtime listener of Dave, Luke, Dori (accidentally listening since 1995), Ron, Don, John, @thenewschick and @joshkerns38. I am so sick and tired of hearing the Cash Call radio ads that every time one of the ads run, I switch over to satellite radio and I’ve been meaning to write this blog post for many weeks so here it goes.

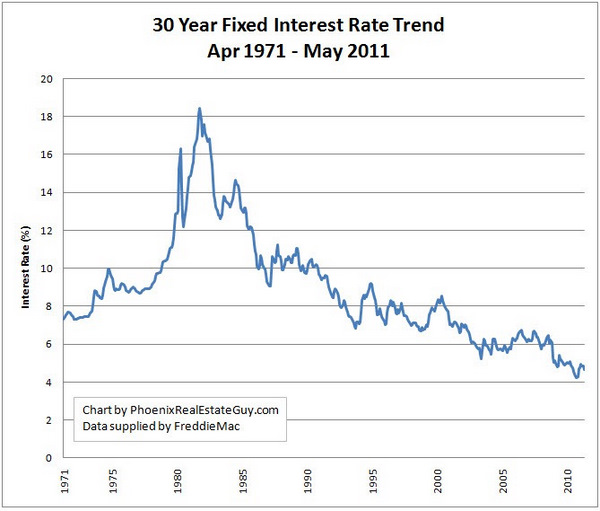

Radio listeners: There’s nothing inherently wrong with mortgage companies that advertise on the radio. This is one business model of many but realize that radio ads are not inexpensive and there are a few ways that a mortgage company can pay for their advertising. One way is to charge you higher interest rates. But wait, how could they do that when they’re advertising low, low mortgage rates?

The answer is one you will not want to hear but I’m going to tell you anyways: The rates advertised are likely NOT the rate that you will get. The rate advertised is for a loan program that only a very small percentage of people will qualify for. People with credit scores above 740. People with lots of equity in their homes, people who want a 10 year mortgage, or in the case of Cash Call, people who ONLY live in the state of California. That’s right, the radio ad that’s running in Seattle comes with one caveat: It’s only avail for California borrowers.

To their defense, the Cash Call radio ad airing on 97.3FM does state that the rate and APR advertised are for a 10 year mortgage but realize that only a very small percentage of people calling that firm will end up with a 10 year mortgage. This might come very, very close to a classic bait-and-switch scheme without crossing over the line but we don’t have enough facts to make that determination. For example, one of the facts we’d need is to know how many people who called in actually chose a 10 year loan v. a 30 year fixed loan. So instead of selling a bunch of 10 year loans, the reason for their radio ad is to motivate radio listeners to pick up the phone and call after hearing the low rate and APR.

So, who’s on the other end of the phone? The answer shows us another way companies that advertise on the radio make money.

Any consumer who is curious about the licensing status of their loan originator can use the Nationwide Mortgage Licensing System’s Consumer Access website to check on the status of a mortgage company or individual loan originator. When searching for the company name CashCall you’ll see many, many licensed LOs, okay that’s good. But dig a little deeper and you’ll notice that each person’s employment history contains many months of unemployment right around the subprime meltdown and lots of jobs held at subprime shops or other companies that only do radio or TV ads…Ditech, Amerisave, Countrywide, and other low wage side jobs outside of the mortgage industry. That leads to the second part of how these companies make money advertising on the radio.

If they can’t offer you the lowest rates they’re advertising, then another way to make money is for the radio-advertising mortgage company to pay their staff a really low fee. This is justified by the firm because…the company is making the phone ring! All the LO has to do is sit there, answer the phone and close the customer. This is loan origination at its worst and if you don’t believe me just simply google: Cash Call Complaints or Quicken Loans Complaints and see how many dis-satisfied customers they’ve left in their wake.

Homebuyers and refinancing homeowners should be wary of ANY mortgage lender that operates out of state and has no physical prescence in your state.

Homebuyers and refinancing homeowners should always check the licensing status of their loan originator here and if their LO is not in the NMLS system ask WHY and ask to speak with their manager. Mortgage brokers and non-depository mortgage lenders must license their LOs. Depository bank LOs begin registering their LOs within the NMLS system this year. Maybe the person on the phone calls himself/herself an intake specialist or a loan arranger. Ask to speak with a Licensed LO. If there are no licensed LOs then you’re probably dealing with a lead generation company and I’ll do a serious smackdown on lead gen firms in another blog post.

Companies like Cash Call and Quicken hire the loan originators who have no client base, don’t want to work hard enough to earn repeat business, only work part time, will work for a low wage, and/or are paid to close deals and not serve the best interests of their clients. Do you want low rates? Go ahead and use one of these companies but you should have extremely low expectations of your rate being as verbally promised or the transaction closing at all. Expect pain and suffering. Some people pay extra for that, but now we’re getting off track.

Do you want your transaction to close? Select a loan originator based on his or her experience and knowledge. Choose a local company with a loan originator located right in your city so you can go into the office and meet with him or her face to face at application. Yes, this will take time. Do you want your transaction to close and also get a fair interest rate? Then that means you will have to invest some time into understanding your options and understanding the documents you’re signing and that means human interaction whether that’s phone, email, text or facebook messages. You will need someone to respond to your questions who knows what they’re doing. It is impossible to be a part time loan originator and serve your clients efficiently because there are far too many changes taking place on a daily basis.

Kiel Mortgage radio ads are great. The radio ads from TILA Mortgage have improved over the years. Best Mortgage’s ads are fine. These are all LOCAL Seattle area companies with local loan originators and company owners who have been serving homebuyers and homeowners for decades.

I notice that on the Cash Call website, and on KIRO 97.3 FM, they’re advertising a “no cost” mortgage loan. Folks, there is no such thing as a zero cost loan. It doesn’t exist unless you’re doing a straight interest rate reduction refinance with your same lender, going through that lender’s loan servicing department and I think it’s even rare that that would happen nowadays with so many banks and lenders immediately selling everything to Fannie Mae or Freddie Mac. Mortgage loans will always have fees and costs involved. Some of those fees will be to the bank funding the loan, other fees will benefit the loan originator helping you, and still more fees will go to third parties. Any company that tries to sell you a “no fee” mortgage loan is lying to you. The fees ARE being charged….they’re just being covered by a higher rate or they’re not telling you about the other third party fees that you’ll pay at closing unless you decide to read the fine print.

So the opening call-to-action phrase on the Cash Call home page is a lie, the radio ads are deceptive and their loan originators are sub-par. I’m sure they’ll make several billion dollars this year, pay a very small percentage of their profits in regulatory fines, and keep on using the radio to find more rate shoppers. It’s a business model that works. Expect more copycats.

Before you look at even ONE house, from IN or even ON an owner’s property, you need to understand the basic framework put into place before the home was listed for sale.

Before you look at even ONE house, from IN or even ON an owner’s property, you need to understand the basic framework put into place before the home was listed for sale.

Yield Spread is a novel written by

Yield Spread is a novel written by