NOTE: This is just my interpretation of the new GFE and I am only a mortgage originator and blogger. This post is just based on my opinion. Please check with your compliance department at your mortgage company to learn about the GFE requirements.

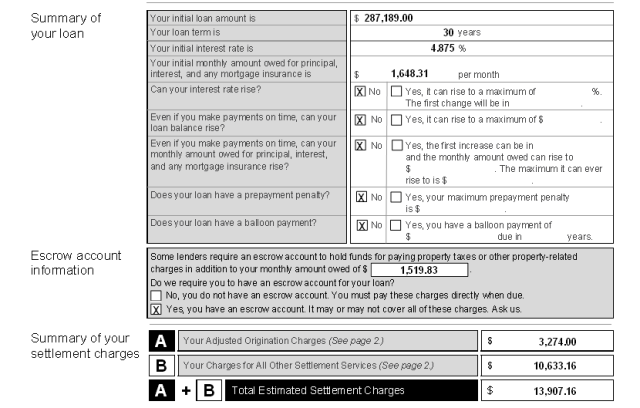

Previously, I reviewed page 1 of the 3 page good faith estimate which will be required for all residential mortgages effective with applications as of January 1, 2010. We’re moving on to page 2 of the new good faith estimate and comparing it to the old Good Faith Estimate that I (and many) have used.

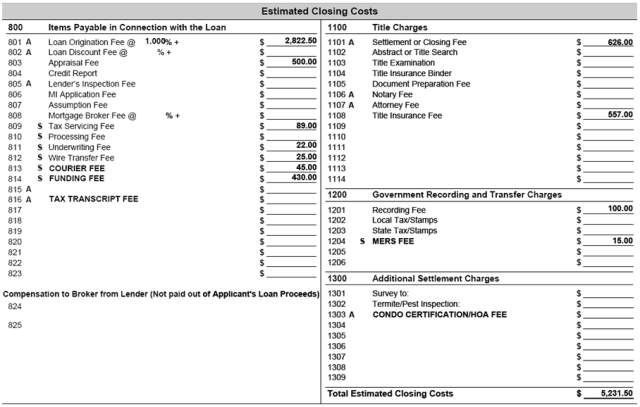

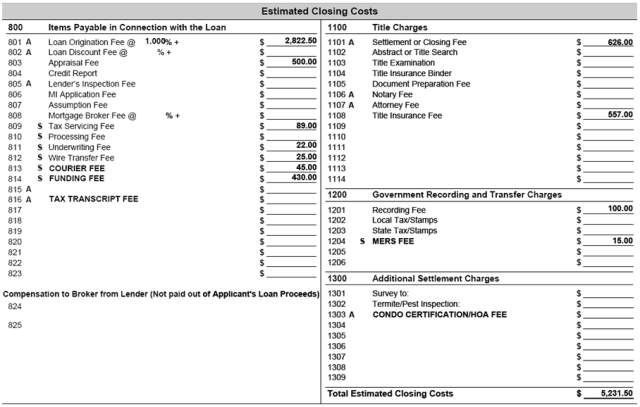

The current good faith estimate, which is to be retired at the end of this year, provides a line itemization of closing costs.

Section 800 of the dear old good faith estimate for the most part contains what the new good faith estimate is now on page 2 of the HUD’s Good Faith Estimate.

What used to be line itemed in Section 800 of the old GFE is now for the most part, lumped together under “Your Adjusted Originated Charges” less third party fees. When you look at the current (soon to be retired GFE); I’m basing this on lines 801, plus lines 811 – 814 even if the seller is paying the fees…by the way, there is no place on the new Good Faith Estimate that shows the seller credit…but if you don’t disclose the funds for closing, I guess HUD feels that point is moot!

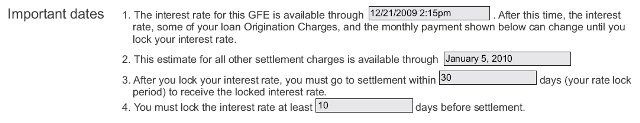

Block one of the Good Faith Estimate cannot change–once a GFE is issued, unless it qualifies for a “changed circumstance” or the GFE “expires”, the Mortgage Originator is bound. A “changed circumstance” is not as easy as it sounds…and warrants a post of it’s own. They must be documented on only the fee impacted by the changed circumstance is allowed to be modified. Mortgage originators should be prepared for banks/lenders to balk at your explanation of the changed circumstance–expect to have to “eat the cost” difference if the bank doesn’t “buy it”.

Quick reminder, this post is just to compare a specific FHA scenario based on a current and the new GFE–so if a LO has discount points or YSP, this would look different and it will take a follow up post to review it.

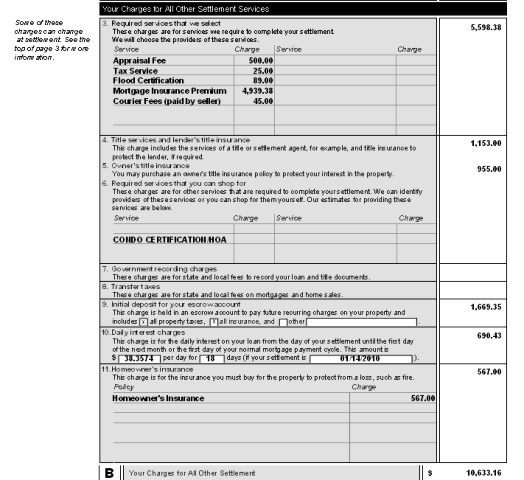

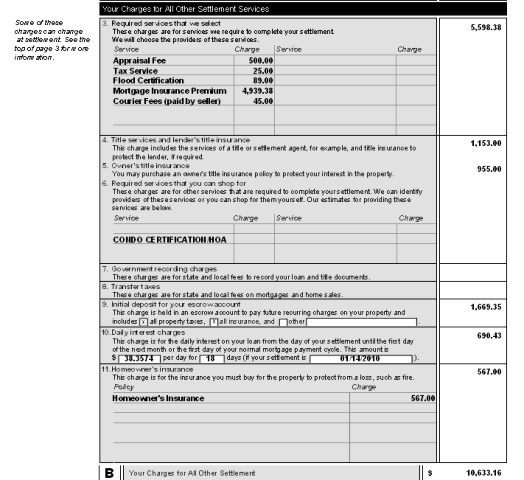

The next section on the new GFE is “Your Charges for All Other Settlement Services“.

Block 3 of this section are items the lender selects and that the borrower cannot. Since this scenario is an FHA loan, it includes the FHA upfront mortgage insurance. This section is subject to the 10% tolerance in aggregate “bucket”. On my old GFE, comparing estimate to estimate, these specific fees would be found on lines 803, 809 and 902.

Block 4 is for the lenders title insurance policy and the escrow fee/settlement services. They’re now lumped together. It doesn’t matter if it’s the same company or not. If the borrower selects a provider from the list provided by the lender, it’s subject to the 10% tolerance. If the borrower deviates from the list, there is no limit to how much the fees can adjust. If the lender does not provide a list, there is zero tolerance from the good faith estimate to the HUD-1 Settlement Statement. I suspect that some big banks will use this to try to capture title or escrow business. On my old GFE, these fees were shown on lines 1101 and 1108.

Block 5 is a doozie. HUD does a great job contradicting themselves with whether or not the owners title insurance policy fee needs to be disclcosed here. In Washington State, this is typically a fee charged to the seller. Yet it really appears as though HUD wants this cost disclosed to the buyer EVEN IF THEY’RE NOT PAYING IT. This fee is not on the old GFE.

Block 7 are the recording fees and is shown in section 1200 of my GFE. Even recording fees that the seller typically pays may be disclosed here. This is shown in section 1200 of my old GFE.

Block 8 is for “excise tax” and it’s my understanding that the only county in our area where the buyer actually pays a portion of excise tax is San Juan County. If I’m wrong–please correct me!

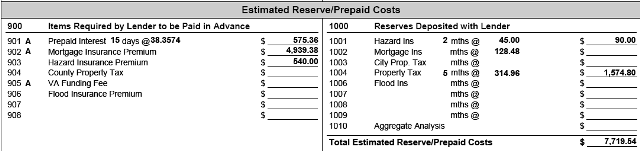

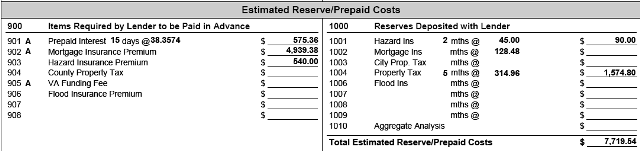

Old/existing Good Faith Estimate below shows the items the lender requires to be paid in advance (prorated interest, 1 years home owners insurance for a purchase and the upfront FHA mortgage insurance) and the left and what is required to start the reserve account. NOTE: this is my personal GFE (generated from Encompass).

Block 9 discloses what is charged to start your escrow reserve account (line 1001 and 1004 on my old GFE).

Block 10 is the prorated interest based on the day the loan is closing (line 901 of my old GFE).

Block 11 is the estimated (in this case) annual home owners insurance premium which is disclosed on line 903 of my old GFE.

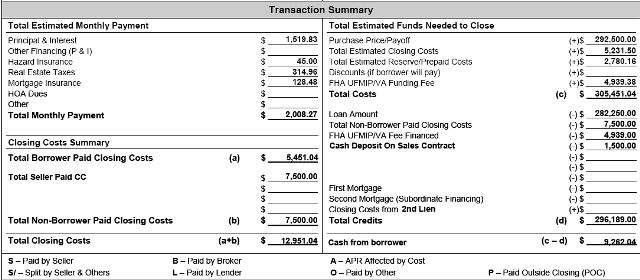

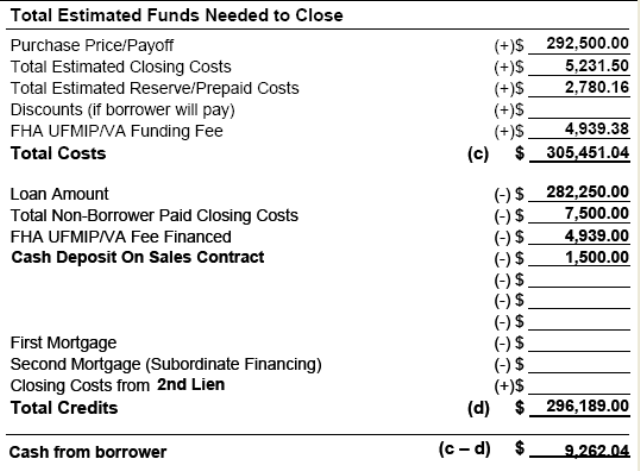

If you add the “adjusted origination charges” (Box A) to the “your charges for all other settlement services” (Box B), you come up with a “total estimated settlement charges” (which also includes the owners title insurance policy which is not paid for by the buyer in these parts). Again, this does not factor in any seller credit–the only credit factored into the new GFE is in the form of YSP (yield spread premium).

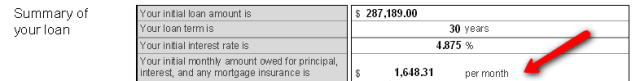

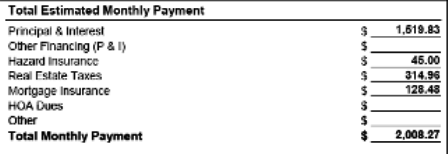

I’m going to miss you, Old Good Faith Estimate! The two things home buyers ask most from the lender (after what’s your rate) is “how much is my payment going to be” and “how much money do we need for the down payment and closing costs”. HUD’s new GFE answers neither.