NOTE: This is just my interpretation of the new GFE and I am only a mortgage originator and blogger. This post is just based on my opinion. Please check with your compliance department at your mortgage company to learn about the GFE requirements.

In a matter of days, all residential mortgage originators (we’re actually referred to as MLO’s now: Mortgage Loan Originator) will have to adapt HUD’s new Good Faith Estimate…warts and all. I promised Ardell that I would show her a comparison between the old and new GFE. I won’t be covering everything line by line on HUD’s new page Good Faith Estimate–I’ve done that all ready…so some parts of this three page extravaganza may be missing from this post.

Page 1

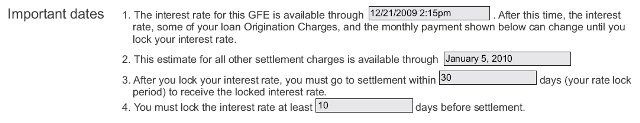

Important Dates (click on image to for better viewing)

This is a new feature to the good faith estimate. GFE’s now have an expiration date if not acted upon by the borrower and certain costs are guaranteed for specific time periods. Sounds great–EXCEPT I think you’ll find many MLO’s not willing to prepare a good faith estimate to the average “rate shopper” since HUD has spelled out that IF a good faith estimate is provided, it’s presumed that the mortgage originator has enough information to have a complete loan application.

In addition, line two states that MLO’s are held accountable for the third party closing costs they are using in their quote for 10 business days. So if I rely on an escrow rate sheet from Tim’s company, and they happen to adjust upward during those 1o business days and the consumer decides to proceed with the rate quote, I could potentially be on the hook for the difference. In reality, there is no way for a MLO to guarantee a third party fee unless they are willing to “eat the difference”.

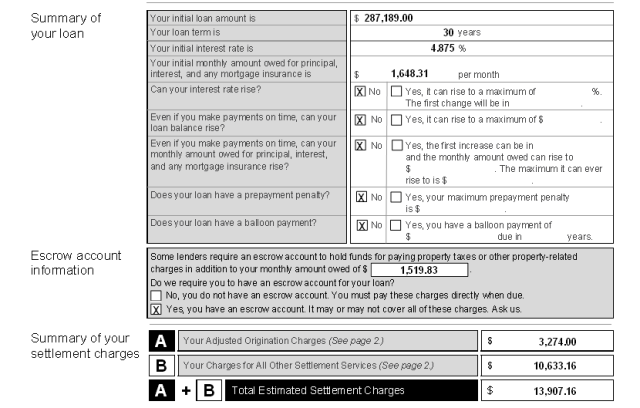

Summary of your loan (click on image to for better viewing)

This section gives you the basics of your loan. For this estimate, I’m using an FHA loan and as I mentioned in my previous post, some of the details may be wrong. For example, this references “initial loan amount”…as I write this post, I’m not 100% sure if this should be your base loan amount with an FHA loan or total loan amount (base plus the upfront mortgage insurance which may or may not be financed–perhaps that’s the fine detail: whether or not the borrower finances the FHA upfront mortgage insurance)…I’ve checked HUD’s FAQ’s (all 51 pages based on the latest update last month) and cannot see where this is addressed… anyhow… I went with base loan amount since other closing costs (such as origination fee) are factored off that figure.

Everything is pretty self explanitory…my issue with this section is the fourth line down:

“Your monthly mortgage amount owed for principal, interest, and any mortgage insurance is: $1648.31”

This payment does not include taxes or insurance. On the old/existing GFE, my clients actually see a total payment (PITI) of $2008.21. PITI is gone on the new Good Faith Estimate…I don’t who’s bright idea at HUD this was…now we have PIMI: principal + interest + mortgage insurance even though the borrower still makes the PITI payment.

Even the next section, escrow account information, restates the “PIMI” where the GFE could have at least stated what the estimated escrow payment (real estate taxes insurance) would be so that consumers could add these two figures together to come to their actual mortgage payment…but no…that might make a bit of sense.

The bottom of page one refers to closing costs that are shown on page 2…which I will address on the next post.

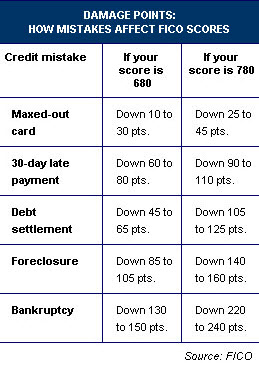

Did you know that if you have a credit score of 780 or higher, you might damage your score more from a single 30 day late payment, than a 680 score person might get dinged for a Foreclosure? Sad but true.

Did you know that if you have a credit score of 780 or higher, you might damage your score more from a single 30 day late payment, than a 680 score person might get dinged for a Foreclosure? Sad but true.