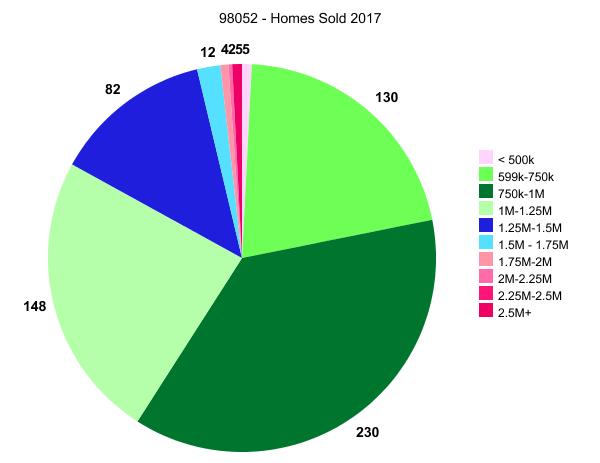

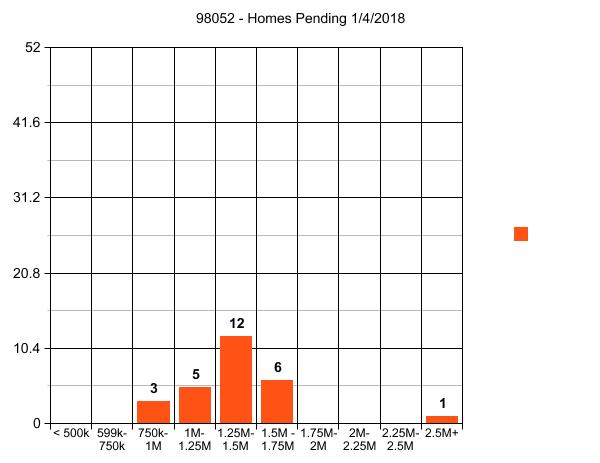

First the graphs…

2018 Home Prices in Kirkland 98033

2018 Home Prices in Kirkland 98033

2018 Home Prices in Kirkland 98034

Category Archives: Ethics

Multiple Offer Situation versus Bidding War: What are they, and why do they happen?

If you’re a home buyer and looking for information on how to win a bidding war (or “multiple offer situation”), check out my insight by following that link. For an academic discussion of the difference between the two terms, and an esoteric analysis of each, read on….

Ardell recently posted on this subject. She noted there really isn’t that much out there about this now-common aspect of buying or selling a home (common, that is, for MLS-listed homes, you can avoid the frenzy by looking for homes on MLS alternatives). She and I then engaged in some typically spirited discourse, which in turn helped me to further frame and analyze the issues raised.

Multiple Offer Situation and Bidding War defined

First, some definitions. A “multiple offer situation” is where a seller receives two or more written offers on the property. A “bidding war,” in contrast, typically refers to oral negotiations between the listing agent and two or more of the buyers’ agents. A bidding war typically erupts, if at all, after the seller has received several written offers. The listing agent then “shops” the best offer in an attempt to negotiate the absolutely best contract possible. (Note that a listing agent can also “shop” the first offer received and before receipt of others, particularly where the seller will not be looking at all offers on a specific date.)

Sellers encourage multiple offer situations by telling buyers that the seller will look at all offers on a particular date in the future. In response, most buyers will submit an offer that includes an escalation addendum (which automatically escalates the offer amount above some competing offer) as well as waive some or all of the usual contingencies (inspection, financing, title, and information verification). So the seller can expect to receive better offers that bid against each other, resulting in a winning offer at the highest offer amount. The seller can sign the winning offer, and the house will be under contract.

If you’re looking for information about how to win a multiple offer situation or bidding war, check out my blog.

When a Multiple Offer Situation becomes a Bidding War

Sometimes, the seller might counter one of the buyers in an effort to get even slightly better terms. If it stops there, not a bidding war. But if the seller – or more accurately the listing agent – then calls ANOTHER buyer’s agent and gives THAT buyer the chance to beat the first buyer… Well, that’s a declaration of “war.”

It sucks to lose a multiple offer situation. For the losing buyers, of course, but also their agents who invested time and effort in the now unpaid endeavor. Bidding wars? That’s acid in the face of buyers and their agents. They are inherently unfair, as not every buyer is included in the bidding war negotiations. So buyers and their agents frequently cry “foul!” when they are subjected to a bidding war.

So is a Bidding War legal? Or ethical?

But is it a “foul” for the seller to instigate a bidding war? No, it is not.

First, the law. A real estate broker owes very few legal duties to the other parties to the transaction. And a broker has no legal obligation to keep the amount or the terms of any offer confidential. So can a listing agent legally shop an offer? Absolutely. Can a listing agent legally call one buyer’s agent, then another, then another, revealing details along the way in order to extract the best offer possible? You bet.

OK, well, what about ethical considerations? Does a broker have a professional ethical obligation to not shop an offer, or not instigate a bidding war? Nope, no formal ethical obligation either.

In the world of real estate, professional ethics are generally set by the National Association of Realtors. Most – but not all – real estate brokers are members of this association, thus earning the title “Realtor.” It is generally accepted that the NAR Code of Ethics sets the parameters of professional ethics.

The NAR notes that offers “generally aren’t confidential.” The Code of Ethics requires a broker to protect and promote the interests of the client. Thus, a seller may “even disclose details about [a buyer’s] offer to another buyer in hope of convincing that buyer to make a ‘better’ offer.” While the Code requires honesty in dealing with others, it does not require “fairness” given that term’s inherent subjectivity. On the other hand, the preamble to the Code notes that the title “Realtor” has “come to connote competency, fairness, and high integrity.” So at least arguably, if a broker discloses the facts of an offer to one buyer, the broker should disclose to all buyers, particularly if that broker is a “Realtor.” [All information in this paragraph pulled from linked sources.]

But that’s a long way from prohibiting a bidding war in the first place. So in fact, there is no legal or professional obligation to avoid a bidding war. Instead, if the seller so instructs the listing broker, the broker has an obligation to instigate one.

So why doesn’t every multiple offer situation result in a bidding war? First, because there are strong informal professional ethics in play, as well as personal ethics. Almost all agents represent both buyers and sellers at various times. So we’ve “walked in the shoes” of a buyer’s agent, and we know first hand how unfair a bidding war can be. And since most of us are in the industry for the long haul, we may need to work with the same agents again down the road. If we treat them poorly today…. Plus, most folks just have a general distaste for this sort of ruthless negotiating.

Second, and perhaps more importantly, bidding wars – like any war! – can end in disaster. If the listing agent shops the offer but all of the buyers are turned off by the aggressive negotiating, then the seller will have wasted the momentum of the multiple offer situation. So there is a good argument to be made that a bidding war, being so exceptionally aggressive, isn’t in the seller’s best interests.

I hope you found this information useful! And if you’re a buyer, hang in there. While inventory is unlikely to improve much today, it certainly will over the next year, or two or three. And if you must buy in the meantime, recognize that it will be a tough row to hoe. Best of luck.

Craig Blackmon is an attorney in Seattle, where he has practiced real estate law for over a decade. His law firm, Seattle Property Lawyer, helps people buy and sell homes without using an agent (as well as handle other legal issues relating to owning a home). He is also a licensed real estate broker and innovator in the real estate industry.

Best Place To Live – Testing Your Parameters

Seattle Area – Choosing Best Place to Live. I recently received a request to write a new post on this topic. Even I find most of the articles I have read on this topic to be very confusing. Like this one that mixes a few “Really?!?” with the obvious best places. Or this one that jumps from one extreme to the other pretty quickly back and forth.

Seattle Area – Choosing Best Place to Live. I recently received a request to write a new post on this topic. Even I find most of the articles I have read on this topic to be very confusing. Like this one that mixes a few “Really?!?” with the obvious best places. Or this one that jumps from one extreme to the other pretty quickly back and forth.

If you are renting vs buying you can use the lists of Best Places to Live in the Greater Seattle Area pretty freely, as you can skip around at the end of each lease until you find a place you may want to permanently call “home”. But if you are buying a home, you need to dig a lot deeper before spending your hard earned money, as switching out is costly and easier said than done.

Since this post is by special request, I asked the requester to give me some basic parameters he has set before beginning his quest as to where to find that type of home, at that price, in the “best” area his money can buy.

With inventory so very low and “best” homes in best areas selling very quickly and often with multiple offers, you can shorten your time frame dramatically by testing your parameters in advance. This way you will not be waiting and waiting for something that simply does not exist in the area you have targeted to search.

Again, these are parameters given to me by an unknown person in an email request to write this post, and not necessarily in the order given.

1) SCHOOL RANKING

The stated objective was:

Elementary School Ranking = 9

Middle School Ranking = 9

High School Ranking = 9

I think we can assume that this person is referring to GreatSchools.org when noting a 9 ranking. The thing that strikes me as odd is that there is a specific number vs a range like 8 to 10. Many if not most of my clients who have school ranking as one of their parameters will most often want 8 to 10 rank for Elementary School. That is a reasonable and common request at Elementary School level but not on all 3 levels.

What bothers me most about someone asking for “a 9 ranking” for school is it leads me to the conclusion that this person thinks school ranking number is a constant vs an ever changing number.

Let’s jump to the areas noted by the person who requested this post and see how this one main criteria alters and narrows even these modest area parameters. Referring to the photo above, nothing “paints you into a corner” faster than School Ranking as a parameter.

“Hopefully Eastside, Bothell, Kirkland, kenmore, Issaquah, Sammamish.”

There are only a couple of high schools currently ranking as high as 9 or better in Seattle. But since this person noted Eastside let’s skip over that for a minute except to say Ballard High School riding high at 9 right now is a big factor in the price run up there.

Kirkland is out, though one of my personal favorite Best Places to Live, given there are only two high schools Juanita weighing in at a 6 and Lake Washington High School weighing in at a 7. I clearly would not rule out Kirkland, but when I first saw this email I thought, well I guess it’s going to be Sammamish…maybe Issaquah, to get all 3 schools ranking as high as a 9.

Bothell High School is running at a 10 as is Inglemoor in Kenmore. Would I or most of my clients exclude Kirkland in favor of Bothell or Kenmore? Not usually. So really have to be careful about the corner you are painting yourself into with this requirement. All things considered, some of which are not in this post yet but are in the email, I’d still be at Issaquah-Sammamish and probably Issaquah I-90 corrider for this particular person.

My general advice for people planning to have children or with very young children just starting school, is to set your ranking based on Elementary School only. Middle school is a can of worms mostly having to do with puberty. Limiting by High School rank leads you into a very small corner, which may be fine as long as you happen to like that particular corner.

– Below $425,000 (may be even going up to $500,000)

– single family home

– town home with no to very low HOA

– area where property value is appreciating. If I buy now (resale after 5 years should be a profit)

– crime should be low

– commuting to Downtown Seattle should be good.

– King County

– newer construction

– few foreclosures in the general area

– areas with construction quality/grade of 8 or more.

Let’s hit these quickly:

King County OK though you can find lower prices outside of King and the Bothell option changes since most of Bothell is not IN King. I’d still be at Issaquah for that reason.

Newer construction…well depends on how you define “newer” but lets say 1995 or newer since home styles haven’t changed much in that time frame.

Few Foreclosures in the general area – When you have a school ranking of 9 or better and a low crime criteria, you usually don’t run into foreclosures generally except in a neighborhood where everyone bought at peak because it was built and sold at peak.

Low Crime is a given on the Eastside for the most part in the Cities mentioned, so not a big factor.

Commuting to Downtown should be good is where I get stuck as to Kenmore which is not known for its “quick commute” to most anywhere.

That leads us to the big one…price.

PRICE OF HOME

I ended with price, but in real life vs a blog post I START with price, because nothing draws a hard line faster than how much you can afford to spend.

I’m thinking Single Family Home is now out of the question and we are moving straight to townhome if “newer” is 20 years or less and High School is 9 or 10. Then we run into HOA dues that are likely going to be considered excessive. Let’s assume for a minute HOA dues of $300 a month and an interest rate of 3.75%. Now we move price to a $425,000 Townhome or a $485,000 Single Family Home being the same, given the $300 monthly dues value at $65,000 of price.

Here’s where the person who asked the question gets to go back to the drawing board with these questions.

1) If Kirkland only has two High Schools ranked 6 and 7 are you ruling out Kirkland altogether?

2) If the only place in Bothell that meets your parameters is in Snohomish County vs King County, do you drop the King County requirement? Bothell runs into 3 or 4 different School Districts pretty quickly.

3) If the only way to get a Single Family Home is to buy an old one vs a new one, do you stop at townhome or change the age of home criteria?

Without having to change anything you can get a newer 3 bedroom townhome in Issaquah High School…possibly Skyline High School, and pretty easily match that up with a high ranking Elementary and Middle School. Many if not most of these are close to I-90 for a pretty fast commute into Downtown Seattle. If 1995 to 1998 Single Family Home appeals to you more than a new or newer townhome, then Issaquah still an option.

Play with your own parameters now. Go to GreatSchools.org and put in the Cities you are considering and set the High to Low on Rank and you will easily see which schools you want to consider, or not, and note them by name. Once you have your complete list of schools it is easy for your agent to find the neighborhoods within those schools that fit your price parameters.

Point being that when you are using school ranking as a consideration you start there and you, the buyer, do the research to make an accurate and complete list of all schools that are an option for you. It is a parent’s job to pick schools…or not. When using this method it is then better to have an agent set you up in the mls for alerts than to use a public site, since it is pretty much the only place where you can put in a big list of schools vs setting up separate searches for each school. That still leaves you in a bit of a jam since individual schools is not a “required” data field. BUT if you start at finding the neighborhoods by looking at sold property over the last year or more…well, it’s a good start and good luck.

Personally, and for most of my clients, they pick their BEST WHERE first…and then find the best schools in that where, vs painting themselves into the corner of only being able to live in one place. Overall if this were my client I’d be adding Redmond to the mix and then choosing between Issaquah and Redmond.

As to Grade 8 or better as to construction, that’s pretty much a given after piling in all of your other parameters. 8 is not very high as to quality grade and new or newer construction is usually an 8 or 9 in modest price ranges. I just spot checked several and most all in that price range are an 8. So leave that check point for last after you find a home and before you make an offer.

It’s Hard Out There for Buyers, Lesson 2: Make Sure You’re Dealing with the “Agent-in-Charge” (It May Not Be Who You Think)

Here’s another quick tale from the trenches as I continue to work with clients at my new real estate firm, this time from the rough-and-tumble market of South King County. Yup, it’s tough everywhere…

My client identified a home in Kent for purchase. It had been on the market for 200 days, with a couple of failed contracts in the meantime (one due to “buyer remorse” and one to failed financing) and nary a price drop. The listing showed an Agent and a Co-agent (both from the same office). I promptly reached out to the Agent, who told me they had no offers and none expected. Within a day or two we submitted our offer at $10k off list. Having heard nothing in response, I followed up with a call two days later. Her voicemail told me she was the managing broker for the office. Good, I’m dealing with the boss…

The Agent called back and explained that the sellers were having health issues and thus the delay in responding. I asked about other offers and was assured there were none. I noted that our offer amount was predicated on us being the only offer, and if another offer appeared to please let us know. In that event, obviously we would take a different tack in the negotiations. I also said that we had no problem at all being patient with the sellers given their health issues, assuming they were indeed acting in good faith and negotiating only with us. The Agent assured me that was the case. Yeah. She said that the Co-agent was trying to meet with the sellers and they would get back to us in a day or two. She said the sellers were likely to counter at $4k off list. Riiiiiight.

The next day, I got a call from the Co-agent. With “the bad news.” Sellers had received a full-priced offer, so they accepted it. Another “WTF?!?” moment. Although signed, it had yet to be returned to the buyers, leaving me a tiny bit of room to maneuver. So I tried to salvage the situation, and the Co-agent at least pretended to be sympathetic. I called the client and got authority to draft a new offer at $1k OVER list – thus beating the offer in hand – but the sellers had made their decision and had no interest in giving me or my clients the time of day.

When the smoke cleared, and the rage had subsided, I though about the lesson to be learned. Always go with full list in this market if it’s within shouting distance of fair? That seems extreme and not consistent with my professional obligations to my client. Recognize that assurances of “good faith” are rendered meaningless the moment a new offer comes in? Yeah, but that’s a little obvious, this is after all real estate. 🙂 Then it hit me: Know who is really “the agent.” You know, the person with the seller’s ear who is actually driving the ship. It may be the “Agent” or it may be the “Co-agent,” assume nothing based on title (even if the “Agent” is also the managing broker!). Listen for clues. When the Agent says, “Oh, the Co-agent will be meeting with the sellers tomorrow,” immediately hang up and call the Co-agent. Don’t waste your breath talking to anyone else. It is a waste of time that will not be helpful going forward.

Another lesson learned. And confirmation that the Quill model strikes the right balance between protecting the client (by keeping an attorney on board and behind the scenes) and getting a deal done (by allowing the Quill agent to take the lead when negotiating a contract).

Home Buyer Education Seminars

I am teaching two Home Buyer Education Classes this month sponsored by the Washington State Housing Finance Commission. Anyone who is interested in buying a home can attend – our class is not limited to first time home buyers.

Home buyers who are interested in programs offered through the Washington State Housing Finance Commission, such as the Home Advantage Program with down payment assistance, are required to take a WSHFC sponsored class.

If you’re interested in attending a class where I will be teaching, you have two opportunities this month:

- Saturday, July 13, 2013 from 11:00 am to 4:00 pm in West Seattle at the High Point Library. My co-instructor is Ira Sarachoff.

- Saturday, July 20, 2013 from 11:00 am to 4:00 pm at the Greenlake Library in Seattle. My co-instructor is Jim Reppond.

Lunch is being provided at both of these classes… however, if you have dietary restrictions (or you’re a picky eater 🙂 you may want to bring your own sack lunch.

Both classes are FREE. If you’d like to attend, you can rsvp here.

I’ve always felt that an important part of a mortgage originators job is to educate their clients and make sure their questions are answered before they get to the signing table. I’m very excited to be a part of the Washington State Housing Finance Commission’s program.

Discrimination – “Love Letters” to Sellers

A Cautionary Tale that Multiple Offers can lead to Discrimination in Housing…somewhat inadvertently.

I had a young couple ask me if they should submit a “love letter” to the owners of the home with their offer. I had not heard the letter called “a love letter” before, but it reminded me that I had used a letter like this back in 2006 or so when the home had over 20 offers. I included a lovely picture of the couple and their two children.

Fast Forward to 2012. This year there were many multiple offer situations and in one case a lovely old couple who had lived in their home since it was brand new and for over 30 years did not choose my clients and I was told it was not about price. ??? What WAS it about then?

Long story short…my clients did get the home. Sometimes Sellers say “I want a nice family who is going to raise their family in “our” home the same way we did”. They identify with the buyers of the home and want to picture a “loving family” in the home that they love so much. They don’t intend to discriminate…but…net result???

There has been a lot of talk over the last 5 or more years about “Why do we NEED an agent?” A reminder that often the agent is the ONLY one in the room who can see when a law is about to be broken…intentionally or not.

We are not licensed to SELL Real Estate.

We are licensed to represent people who Buy and Sell Real Estate.

Many agents believe that they are simply passing paper back and forth between buyers and sellers and must follow the instructions of their clients. This is a CAUTION that many people need to be told when they are entering into that gray area of “unlawful” as it is not always blatant discrimination.

Sometimes the seller asking

“which offer is from that cute couple with the baby?”

IS discrimination.

The agent should say: “Let’s look at these offers on their merits, without regard to WHO is making the offer”. People who discriminate often do it quietly, without notice, and sometimes scream the loudest that they are NOT…when someone calls them on it.

Where Should I Live?

Not every client asks me where they SHOULD live. But the question comes up from time to time, and often from family members who are considering jobs in more than one city.

I am answering a more complex one for a family member who hopes to purchase a home vs rent. Scenario is they are graduating with an RN and looking at:

Los Angeles $82,000 Salary

Seattle $74,000 Salary

Colorado $71,000 Salary

The issue when people ask me is usually whether or not the salary differential makes up for the difference in the cost of the housing in various places. The offered salary is $11,000 more in Los Angeles than in Colorado, but does that compensate sufficiently for the difference in housing cost? In the past the scenarios presented to me were about renting vs buying, and often the differential did make up for that difference in rental cost. But when someone is buying vs renting…not necessarily the case.

In this particular example I am looking at Entry Level housing, VA Loan with zero down and a family that already has two children and is planning to have more children. So I need at least 3 bedrooms on this entry level housing.

Starting with “Seattle”…I know that the person is interested in The Eastside Cities of Kirkland, Bellevue or Redmond. For this “entry level” example, I am going to use a home that closed on Wednesday for one of my buyer clients BUT putting in the loan scenario of the family member of mine who is asking the question.

Price SOLD is $355,000. Plenty of space and yard for a growing family. Cul de sac lot. Could use some updating, but no expensive fixes needed. Had one owner for 44 years since it was built, in 1967. A good indication that a family can live there indefinitely without needing to upgrade to a larger home.

Now we’re matching this home purchase up to the above RN Salary for “Seattle” of $74,000 for the person asking the question, vs the person who actually bought it the other day.

First we’ll use the “rule of thumb” of 3 to 4 times annual income for the loan amount. That would put the loan, based on $74,000 Annual Income, at $222,000 to $296,000. A little short based on Zero Down for this home.

I’m going to move this WA scenario over to a home I sold in Mt. Lake Terrace that is a similar home, big lot, with a one car vs two car garage, but that sold for $250,000 vs $355,000. Edmonds School District. A reasonable example for Mt. Lake Terrace or Brier.

Now we go back to our 3X to 4X Gross Annual Income “rule of thumb”. and we can fit $250,000 into that $222,000 to $296,000 equation without approaching the upper limit. NEXT we go into the actual real detail of payments, which isn’t worth doing if the Rule of Thumb = No Way, Jose.

Conservative numbers put monthly housing payment, whether that be rent or mortgage payment, at 28% of MONTHLY GROSS income. VA guidelines are usually 40/40 ratios, allowing people with no debt to put the entire debt budget on home. This Family is a Zero Down…but also a Zero Debt, so they can go somewhere between 28% and 40% as the housing payment.

I am not a Lender…so you have to check the ratios with an actual lender before making offers, but since I don’t recommend going to 40% on housing payment even if you have no debt…as you may incur debt at a later point, let’s proceed.

This family would have ZERO Closing Costs on the above $250,000 scenario as they can be included in the price with a Seller and/or Agent Credit to cover the Closing Costs entirely. So we don’t have to factor in Closing Costs on the WA scenario. That will change for the other cities.

Rates are very low today…too low to use for this scenario, so I’m going to pump the rate up to 3.75%. We are going to stack the VA Funding Fee on top of the price for Loan Amount and Payment purposes. That amount is $5,375. It can be fully or partially paid as part of the Closing Costs, but let’s assume a stack on this one taking the Loan Amount up from $250,000 to $255,375 at 3.75% is . Property Taxes are $250 a month. Homeowner’s Insurance is $50 a month.

NOTE: There are different VA Funding Fee rates for different scenarios. Putting 5% vs ZERO down can reduce the Funding Fee by almost 2%. I have used a rough scenario based on the person who asked the question. These Funding Fee rules change from time to time, are different for Refinance vs Purchase Loans, whether you were in Regular Military or National Guard and whether it is a 1st time or subsequent use of the privelege. See your local lender for specifics.

OK…back to the payment on the $255,350 Loan Amount at 3.75%. $1,182.57 for the Principal and Interest plus $250 for RE Taxes plus $50 for Home Insurance (Fire, etc.) gives us a monthly payment of 1,482.57. That happens to be pretty close to what the home would rent for, probably less than rent for this style of home in other nearby places like North Seattle or Lake Washington vs Edmonds School District. Not sure about Northshore School District, which would also be in the mix as to Bothell homes. But all in all, a good basic scenario.

Back to $74,000 Salary in WA and $1,482.57 a month housing payment. $74,000 Annual Gross Income divided by 12 gives us $6,166.67 Gross Monthly Income which puts $1,482.57 a monthly PITA at 24% of gross. At 40% of Gross Income the monthly housing allowance would be substantially more at $2,466.67. $2000 a month PITA would be a loan amount of $430,000. hmmmm.

Let’s go back to the Rule of Thumb. $430,000 is 5.81 X Annual Income vs 3 to 4 times Annual Income. Low Interest Rates do impact this rule of thumb issue, but still…going over 4X Annual Income just doesn’t look right.

Let’s go back to the first house at $350,000. That payment would be $1,679.41 plus taxes of $330 a month plus insurance of $75 a month would be $2,084.41 a month or 34% of monthly gross income. That’s really enough to spend on housing, and likely appropriate in this case as we are only using one income at an entry level salary. So the payment will become more affordable with some supplemental income from the other spouse and future raises.

So let’s say either of the above examples will work…as well as something in between.

That’s the hard part. Now let’s throw up a $250,000 home and a $350,000 home in Colorado in the Cities of preference as noted by the person asking the question.

Most Every Home in Parker Colorado fits the bill. No problem there. So Parker Colorado, even at a few thousand less in Salary down from $74,000 in WA to $71,000 in Colorado…very easy to get a house for $300,000 give or take.

This big 5 bedroom, 3,200 sf home in Parker is listed at $314,900 and there are plenty of others to choose from. Easy to see why Parker Colorado made the list of options.

Castle Rock, another choice in Colorado, is even lower priced. This new 3,530 sf new home is listed at $288,000. But Parker doesn’t seem so far out of the way, and is plenty affordable.

That’s all I can say about Parker and Castle Rock Colorado, as I don’t know the area at all. It works, so it would depend on the salary offers in the various locations. WA works. Colorado works. Now to L.A.

We have a bit more room here, as the salaries are higher by $10,000 or so as the average. Using the same 34% of Gross I used above vs the 40% allowance, and using $82,000 as Gross income is $2,325 for housing payment. Let’s use $1,900 after taxes and insurance. That gives us a home price of $400,000 allowing the extra $10,000 for VA Funding fee on top of the mortgage.

What does that buy in L.A. in the specific areas of interest?

It doesn’t buy us anything in Walteria, one of my favorite not too Ritzy places. 🙁

It doesn’t buy us anything in Redondo Beach, even when I throw in 3 bedroom condo-townhomes.

There are a few in NW Torrance that would work, but they are short sales, so not sure if that price is reflective of “the going rate” for the area.

This 3 bedroom 2 bath, 1,468 sf home at $365,000

This house looks nice, but you can see a huge electrical tower behind the house.

Obviously L.A. is not as doable as WA or CO, so the salary difference would have to be higher. If the salary offer in L.A. was double that of WA and CO…well we can revisit this. But for a small difference…may not be worth it.

Let’s find an L.A. house and work the salary backward.

Well…I can’t find any for sale BUT the GOOD NEWS is I did find a few in Redondo Beach that SOLD. So the answer is there are a few…but the sell very quickly.

This one sold for $419,000. It’s only 914 sf though. 3 bedroom, 1 bath, but small. Nice sized lot and yard though…and it is warm and sunny enough to be outside most of the time year-round, unlike WA and CO.

This 3 on a lot sold for $410,000. Nice Street. 1,612 sf with 3 bedrooms and 2.5 baths.

BOTTOM LINE: All three are potentially doable…enough so to put out resumes in all three areas and see what kind of offers come in. WA is probably the best option for several reasons. L.A. is doable IF the salary offered is high enough…OR…if you rent for a bit until the salary improves by raises. Parker vs Castle Rock is probably an excellent option. Depends on how close to the actual work site they would be.

The purpose of answering the question “Where Should I Live?” is not to really answer the question, but to give some food for thought. There are some other considerations like schools and safety, but I already know the not Colorado options well enough to factor that in and the Colorado Cities seem to have pretty much ALL good schools. There are a couple of exceptions in Castle Rock, and I still prefer Parker for several reasons, but most Castle Rock Schools are pretty darned good except for one or two.

Shooting this link to the person who asked the question. Hope it helped someone else with the general “thought process” and work through format. No matter where your thoughts travel as to “Where Should I Live?”, it’s not to hard to do a comparison based on Salary Differences and Home Price differences. The cheapest homes are not always the best choice…nor is the highest salary.

Of course I’d have to say WA vs CO, but to compete, I’d have to throw in a nice looking house for $350,000 in Duvall. 🙂

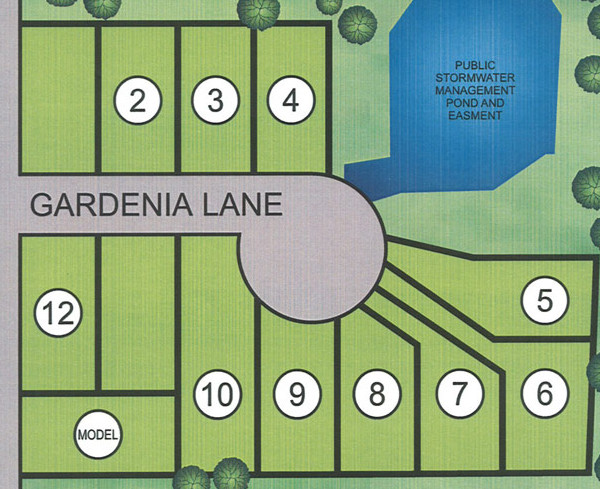

Buying New Construction – Choosing the Lot

The first step in buying a new construction home, unless it is an already built “spec” home, is to choose the lot. However, not all lots can hold all homes. So to some extent you have to choose both the home to be built and the lot at the same time.

Let’s look at a small subsection of a fairly standard looking new construction development as to variations of lots available.

Choosing the lot is likely the most critical phase of buying a new construction home that is not a spec home. It used to be a lot easier to pick the best lot…or at least a good one. A standard lot was built into the price of the home and there was a “lot premium” for the other lots. Let’s say the lot premiums ranged from $2,000 to $15,000. That gave you a gauge as to how much better than a standard lot, the lot you were selecting was.

Unfortunately those days are gone and most salespeople will tell you they are all “best” lots.

Looking at lots 1,2,3 and 4, lot 4 would usually have a premium as it sides to an “open space”. You might say the same for the corner Lot 1. But if the street to the left of Lot 1 is a very busy road…now it is a lesser lot without benefit of no neighbor to the left. In essence your “neighbor to the left” is a bunch of dirty, noisy traffic. Some people feel the same way about the drainage basin to the right if it is ugly and attracts mosquitos. Sometimes people think the drainage area is going to look like a “pond” the way it states on the site plan…and sometimes it does. But more often it looks like an unkempt ugly drainage pool.

Trees? Good Drainage Issues? Can you see a green, yellow, red blinking street light from your master bedroom window? All too often someone picks the lot without standing on the lot…bring a ladder. Stand higher. 🙂

Choose the best lot and the worst lot and assign values from there. Don’t do this from a site plan like the one above without walking the entire area to see what is on the outside of those perimeters. Will there be more new homes to the North or are there existing run down homes with a few junkyard dogs.

You have to get very close to picturing the home on this lot the same way you would if you were buying an existing home on that lot. This is VERY difficult for most people.

Generally speaking only people who buy the BEST lots choose the lot and build from scratch. It makes little or no sense to build a home on a substandard lot vs waiting to see what the home looks like on that lot.

So if all of the best lots are gone…you are often better off buying a spec home or a newer resale home, than building on a substandard lot with no recourse to not “like” it once the home is put on it.

New Construction is not for everyone. If you can get the biggest and best lot in the neighborhood…go for it! The end result can be very rewarding.

Low Inventory? Be Pro-Active

Low Inventory continues to be an issue for many. This weekend there were so many people at one of the houses I was showing, buyers with their agents, that it looked like an Open House. A few days before agents and buyers were standing in line out front (different house) waiting to “show”.

This is often the case with new listings this time of year, and just because there is a crowd in the first few days does not mean the house will sell in short order. The first one I mentioned did have 5 offers by late afternoon, but the 2nd is still Active with no offers.

One of the ways to be pro-active about inventory is to identify what you want in advance. If you have seen many houses over the last 6 months to a year and know which neighborhoods you want to live in, you can contact owners to find the one or two who are planning to list their homes in the next several weeks. It could give you a leg up.

I have a client who wants to spend about $400,000 for a house in X area. The best homes at that price are in X neighborhood. Only about 50% of the homes in that neighborhood fall at that price. You should not contact ALL of the owners in that neighborhod. Rather sort by square footage and assessed value.

1) If you know the minimum size of home you want is 2,200 sf, then first eliminate all of the small homes from the list using the tax records.

2) If you know you want to spend no more than $400,000 to $450,000, and all of the recent sales in the neighborhood have been at roughly 1.13 X Assessed Value (which is about the “going rate” right now for good areas and homes) you can next sort by Assessed Value. The lower valued homes you likely already ruled out based on square footage. So in the 2nd sort you are knocking off those that will sell for more than you want to spend. If 30% of the homes are assessed at more than $450,000, you can knock those off the “pro-active” list. Doesn’t mean one might not hit the market as a short sale or REO listing. Just means they are not the “target” for pro-active contact.

Now you have a nice list of 50% of the homes in the neighborhood that should be large enough for you, and should sell at the price you want to spend. Odds are maybe at least one or two of those are thinking about selling this Spring, and will be happy to not have to worry about whether or not it will sell. They may receive your letter and be very happy to have a ready, willing and able buyer without having to list their home.

I am not saying that is the best way for a seller to approach selling their home…but for a buyer who is fed up with the waiting game, only to find 5 offers when a suitable house comes on market, this is not a bad way to jump to the front of the line.

Being Pro-Active vs Reactive also feels like you are doing something to reach your objectives, and can be a very rewarding strategy.

Seattle 4/3 Cape Cod with a View

Some time ago I wrote about Seattle Starter Home Styles and we talked about the value of having bedrooms up above the main floor vs down in the basement. While that would describe most any 2-Story home, before we get to 2-Story we have the one and a half story “Starter Home” Style. This one happens to be a Cape Cod…

with a view.

I am reminded while listing this property of The Tim’s comment of another home featured over on Seattle Bubble:

“The listing agent claims that the home’s architectural style is “Cape Cod,