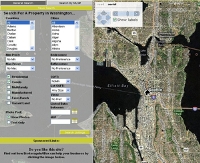

[photopress:hotpads.jpg,full,alignright]Thanks to John Cook post on Real estate timeline debuts, I found the greatest site for Apartments, Rentals, Sublets and Roommates I have seen. HotPads.com provides users with the ability to find dwellings based on Density, Per Capita and Median Age/Renters/Rent. They even use census data to color code their maps based on this data. For the property owner they create listings on HotPads is free and easy! If you are a landlord, they eve send your listings to Oodle and Google Base.

HotPads currently uses census data to color code our map based on a few different statistics:

- Population Density

- Per Capita Income

- Median Household Income

- Median Age

- Percent Renters

- Median Rent

Here are some examples from Seattle: Seattle, WA

Per Capita Income

[photopress:wa_seattle_perCapitaIncome.jpg,thumb,centered]

Household Income

[photopress:wa_seattle_householdIncome.jpg,thumb,centered]

Median Age

[photopress:wa_seattle_age.jpg,thumb,centered]

Percent Renters

[photopress:wa_seattle_percentRenters.jpg,thumb,centered]

Median Rent

[photopress:wa_seattle_rent.jpg,thumb,centered]

Even though rail stations are not available in the Rain City yet, with HotPads maps you can see various points of interest that might help you decide where to live:

- Subway and Train Stations

- Public Schools

- Private Schools

- Universities

[photopress:hotpads2.jpg,full,centered]

Points are added to the map with their nifty icons:

Colleges

[photopress:university.png,full,centered]

Schools

[photopress:schoolhouse.png,full,centered]

Train and Subway Stations

[photopress:trainStation.png,full,centered]

They are currently listing the following rail systems:

- New York City Subway

- Washington, DC Metro

- Bay Area Rapid Transit

- Bay Area’s Caltrain

- Boston’s MBTA

- Chicago’s El

- Los Angeles County Metrorail

- Denver’s Light Rail

- Dallas’s DART

- Miami-Dade County Metro

As John Cook pointed out (looks like Galen has added Shackprices‘ GREAT search to the list), their Real estate timeline is pretty cool too:

[photopress:hotpadstime.jpg,full,centered]

Redfin released a report today (it was yesterday, but I am on vacation… I guess you can say Maui Time :)) that opens saying, “Finds .904% Negotiating Advantage, 1.952% Average Commission Refund, 95% Customer Satisfaction; The Most Common Type of Redfin Buyer is a First-Timer

Redfin released a report today (it was yesterday, but I am on vacation… I guess you can say Maui Time :)) that opens saying, “Finds .904% Negotiating Advantage, 1.952% Average Commission Refund, 95% Customer Satisfaction; The Most Common Type of Redfin Buyer is a First-Timer

My biggest gripe with Redfin has been their use of space, most notably the size of their map. In my eyes you could get an idea of the neighborhood, but not a great idea without knowing the area already. Virtual Earth’s full size maps on the other hand were and are great. NWMLS made us change the name of the map because of the words MLS in the URL.

My biggest gripe with Redfin has been their use of space, most notably the size of their map. In my eyes you could get an idea of the neighborhood, but not a great idea without knowing the area already. Virtual Earth’s full size maps on the other hand were and are great. NWMLS made us change the name of the map because of the words MLS in the URL.